Everyone

wants to improve their quality of life.

Quality of life improves as we have less negative stress and more peace

in our life. One area of negative stress

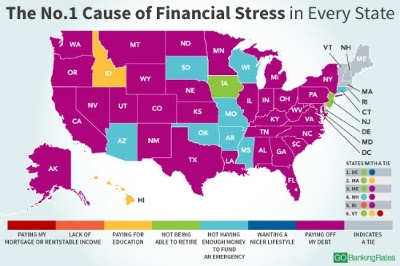

that most people have in their lives is debt and living paycheck to paycheck. In fact, the number 1 cause of financial

stress in New Mexico is “paying off debt.”

New Mexico has the third-highest unemployment rate in the nation, tied

with Louisiana and Illinois, according to the Bureau of Labor Statistics.

Without a steady income, residents might be relying on credit more or having

trouble coming up with the cash to pay the debts they have. Sometimes people

find themselves in debt because they don’t have enough income to meet the most

basic needs. Most people, however, are

in debt because they spend money they don’t have on wants.

George Clason once said, “That which each of us calls our ‘necessary expenses’ will always grow to equal our income unless we protest to the contrary.” In other words, our expenses grow as our income grows because we believe we can spend more. Most of us look at our income and think, “If I could only make $xxx more each month, then I would be fine.” But, what we find out is that once we get the raise and have the extra money, we are STILL living paycheck to paycheck and barely making ends meet. Why??? Because we don’t control our spending! Improving our financial situation is usually more about decreased spending than increased income.

The Growth of Consumer Debt

The debt problem in the United States has grown dramatically

over the past few decades. Between 1970 and 2010, the median family income in

America increased 10 percent in real (or

purchasing power) terms. During the same time period, total consumer debt per

capita increased 119 percent in real terms.

If you want a sobering picture of debt in the United States, go to www.usdebtclock.org, which projects debt in the

United States in real time. Don’t go there

if you are susceptible to heart problems, because what you will see is truly

heart-stopping! I visited the site on October 5, 2016 at

about 3:00 PM, and this is what I saw:

• Total Student

Loan Debt: $1,386,074,261,657

• Total Credit Card

Debt: $975,127,632,454

• Total Mortgage

Debt: $14,108,106,892,145

• Total Personal

Debt: $17,807,638,322,093

As I viewed this continually updating screen, I saw the total

personal debt increase by thousands of dollars every second. Personal debt is

rapidly exceeding 17 trillion

dollars (a

trillion is a million millions). That’s a lot! This amount translates into

$54,021 of personal debt for each of the 323,281,052 people living in the

United States.

The United States national debt is also growing to

astronomical proportions. As of October 5, 2016, it was $19,539,926,482,257,

which translates into $59,486 for each person in the United States. If you want

to better understand how much debt $19 Trillion is, visit the following two

sites: 1) US debt graphically depicted - http://demonocracy.info/infographics/usa/us_debt/us_debt.html and 2) How much is a trillion

dollars? - https://ihtd.org/festivalguide/resources/how-much-is-a-trillion-dollars/.

Here it gives multiple examples to help you understand the value of a

trillion dollars. For example:

·

If

a person’s salary is $40,000 per year it would take:

o

25

years to earn $1 Million

o

25

Thousand years to earn $1 Billion

o

25

Million years to earn $1 Trillion

So if you combine personal debt with the national debt, there

is enough debt for more than $113,000 for each person in the United States. We

are truly a nation of debtors—both in Washington, DC and in our own homes. So what can we do?? We discuss various solutions next.

Dave

Ramsey said, “It is human nature to want

it and want it now; it is also a sign of immaturity. Being willing to delay

pleasure for a greater result is a sign of maturity. However, our culture

teaches us to live for the now. “I want it!” we scream, and we can get it, if

we are willing to go into debt. Debt is

a means to obtain the “I want its” before we can afford them.” What should we do? We need to distinguish between needs and

wants. What are our basic needs? Basic needs are food, shelter, and clothing.

But within these basic needs, we need to be modest.

· Food

IS a necessity, but going out

to eat every day or eating expensive food is NOT a necessity. We should buy healthy, inexpensive food at

the grocery store to make at home and refrain from going out to eat until we

are debt free and can add the extra food cost to our budget.

· Clothing

IS a necessity, but expensive

outfits or additional outfits when we have enough clothing is NOT a

necessity. Can we get by with the

clothing we have until we are out of consumer debt and can save and pay

cash? If we do need an item of clothing,

can we purchase a good quality item at a location that is inexpensive (e.g.,

Walmart, Target, etc.)? When in debt we

should go by the mantra “Fix it up, wear

it out, make it do or do without.”

· Shelter

IS a necessity, but it should

be a modest shelter that fits easily within our budget. Whether renting or owning, limiting the

amount of our income that goes toward housing will allow us to use our finances

to accomplish other financial goals.

Having a home that stretches the limits of our income, restricts our

choices and ability to accomplish other worthwhile financial goals.

If

we can live frugally now while we become debt free and build a reserve, later

we can increase our standard of living while spending less than we earn. Research, and common sense, shows that

minimizing our expenses while attacking our consumer debt until we are debt

free brings peace of mind. We should do

all we can to decrease our expenses and increase our income while becoming debt

free.

Spending Leaks

What

is a spending leak? A spending leak is when we spend money on wants rather than

needs. We each have multiple spending

leaks every month, week, and possibly each day.

Similar to how a continual drop in a bucket will fill the bucket with

water over time, spending leaks will add up to an extremely large amount over

time. Spending leaks can be candy,

cigarettes, chips, soda, alcohol, vending machines, coffee (e.g., buying

Starbucks vs. making it at home), newspapers, magazines, going out to eat (fast

food or restaurants), unintended fees (e.g., late fees, overdraft fees, etc.),

spending too much on cable, dish, cell phone, etc. (especially when we don’t

use all the channels, data, etc. to the fullest), gas (when driving more than

needed), and many other ways. Spending leaks

are the things that add up over time but when looking back we aren’t sure where

our money went. These leaks are severely

limiting our ability to accomplish our financial goals; goals like getting out

of debt, building an emergency fund, and saving to pay cash for a vacation,

car, or other goal.

The

only way to find out where your spending leaks are so you can redirect the

money towards getting out of debt and accomplishing your other goals is to

TRACK every expense over a month. You

can track your expenses by only using your checking account (debit card or

checks) and/or a credit card and using the statements, you can write everything

down as you spend, or you can use a tool like Mint.com. The important thing is to track every

expense, especially those expenses that are considered spending leaks. If you are like my students (who also get to

track every expense for a month), you will be AMAZED at how much you spend on

going out to eat and other spending leaks.

Most of the time spending leaks add up to thousands of dollars per

year!! If you were to LIMIT (not even

eliminate) your spending on these leaks, you would find the money you need to

get out of debt. Until you do this, you

cannot use the excuse, “I don’t have enough money.”

Debt-Elimination Calendar

In

order to accomplish your family’s financial goals, debt elimination is

imperative. What if your family is already in debt? Is there a process that can

help you get out at an accelerated rate?

Thankfully, there is. The

following process is essential for debt-reduction:

1. Recognize and accept that you

have a debt problem.

2. Stop incurring debt. Don’t buy

anything else on credit. Be especially careful about using home equity to pay

down debts until you have your spending under control. In the words of Will

Rogers, “If you find yourself in a hole, stop digging.”

3. Make a list of all your debts.

4. Look for many different ways of

reducing debt, not just one. Examples might include consolidating balances to a

lower interest rate credit card, having a yard sale to earn money to pay down

debt, taking a second or third job for a short time, or using savings to reduce

debt.

5. Organize a repayment or

debt-reduction strategy, such as a debt-elimination calendar, and follow it.

Many financial planners

suggest organizing debts, then paying off either the most expensive debt first

or your smallest balance owed first (my preference). With the smallest balance first approach, you

see success as smaller debts are eliminated, which gives you more motivation to

continue repaying your debts. Either of these methods can be helpful in eliminating debt. Most of the

time, the difference is not significant, and either method will accomplish the

same objective. The key is to act now!

An

excellent tool to help accomplish either debt elimination strategy is https://powerpay.org/. This

website is an easy tool that creates the elimination calendar for you and will

calculate how long it will take to eliminate your debt and the overall cost

savings of eliminating the debt. For

most people, it saves years of debt and thousands of dollars saved in interest.

How this Applies to

YOU…

Although the Unites States is in over 19 Trillion dollars of

national debt and its citizens are in 17 Trillion dollars of personal debt, YOU CAN BE DIFFERENT!!

·

Distinguish between needs and wants and identify

where you can cut spending.

·

Show greater maturity by delaying gratification

by saving and paying cash or not making the purchase.

·

Live within your means by not spending more than

you earn.

·

Track your spending and minimize your spending

leaks.

·

Create a debt-elimination calendar (use https://powerpay.org/ to help), attack your

debt, and be debt free years earlier while saving thousands of dollars in

interest payments.

The Bottom Line –

New Mexico, along with most other states, has “paying off

debt” as the number 1 cause of financial stress. We can relieve that stress by tracking our spending,

identifying and plugging (reducing) our spending leaks, spend less than we earn

and live within a budget, and attack our debt with the debt-reduction calendar.

As we see our debt decreasing and that we are winning financially, instead of

missing the spending leaks, our financial stress will go down and we’ll feel in

control of our finances! We’ll feel

great that we are making progress towards our financial goals. This will bring more peace into our lives and

into our relationships and our quality of life will increase.

To learn more about these topics, visit www.mymoney.nmsu.edu and/or contact your

local extension office to talk with a Family and Consumer Science extension agent.

By: Bryce Jorgensen, PhD

Family Resource Management Specialist

No comments:

Post a Comment